Home

(email questions/comments to wrightted@aol.com).

Ted Wright -- last update 11/2/2007 (ChamberNov1Yazel.html)

www.cvilleok.com

Copyright 2007 -- Collinsville, Oklahoma

|

Collinsville

Chamber of Commerce

Nov. 1, 2007 Tulsa County Assessor |

|

This web site is brought to you by

the Newspaper

Museum In Collinsville and the other advertisers appearing on these

pages. If you would like to provide content or advertisements ...

call Ted Wright (918) 371-1901 or send email to wrightted@aol.com. |

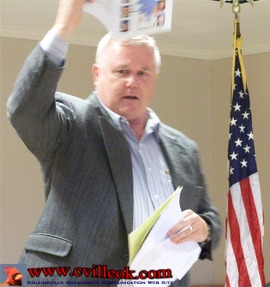

Tulsa County's Assessor gave a refreshingly candid view of county taxes and regulations at the November general meeting of the Collinsville Chamber of Commerce. Ken Yazel provided graphics showing Tulsa County not only had the highest overall taxes in Oklahoma but also in the neighboring states as well. Using weighted averages for differences within the county an example of property taxes on a $150,000 property were shown as $1988 for Tulsa County. The same $150,000 property would be taxed at $1779 in Oklahoma County (OKC) or an average of $1710 statewide. The Collinsville rate on that property would be $1745.

Yazel explained millage rates in each of the school districts in Tulsa County with Collinsville at 105.76. Jenks School District was the highest at 132.55 and Leonard the lowest at 84.75.

The County Assessor covered many other topics and examples which I won't attempt to cover here. I did take an extra set of handouts if someone would like to learn more about taxes in Tulsa County. The phone number for Tulsa County Government is (918) 596-5000 and the web site is www.tulsacounty.org.

|

Don't

Forget To File For

Homestead Exemption If Your Residence Changed This Year |